It is a business lending model with respect to the buy now pay later model which is generally used by most people at some point in time. But do you know how it is implemented? We know that lazy pay, simply, and many other companies are there which work on it when they are lending small amounts for a short period of time. It allows consumers to make purchases but pay for them at a future date. These are often interest-free and also referred to as point-of-sale installment loans.

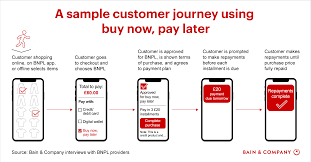

How does it work?

- Download an application.

- Connect a bank account or debit or credit card.

- Sign up to pay the installments either monthly or weekly.

- Most are approved in minutes.

- Scheduled payments will start deducting automatically from your account or charged to your card.

Top players in India

- ZestMoney

- LazyPay

- Simpl

- Amazon Pay later

- Ola Money Postpaid

- Paytm Postpaid

- Flexmoney

- EPayLater

- Capital Float

Eligibility to use it Buy Now, Pay later

- You must reside in India.

- Your age must be above 18 years.

- The upper age of eligibility in some cases can be up to 55 years.

- You must be a salaried individual.

- It has a bank account and all the KYC documents.

Scenario in India

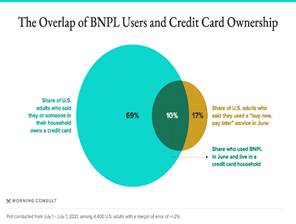

The central bank has been monitoring digital lenders. More than 650 suggestions/complaints regarding KYC irregularities came into the picture. Some cases arise where loans are given to individuals without their consent. A committee was made by RBI and noticed that there are around 1100 illegal digital loan providers across the country. India currently has around 22-25 million BNPL users, former governor of RBI Mr. Shakti Kant Das said that “Big tech’s play in finance poses systemic concerns like overleverage that is giving more than enough will lead to systemic challenges in the economy.

RBI Guidelines for buy now, pay later

The Reserve Bank of India released a regulatory framework for digital lending on the 10th of August 2022. An execution plan for the recommendations of the Working Group on Digital Lending (Working Group).

a) The Universe of digital lenders is classified into three groups-

- Entities controlled by the RBI and permitted to carry out lending business.

- Entities sanctioned to carry out a lending as per other statutory/regulatory provisions are not regulated by RBI.

- Entities lending outside the purview of any statutory/ regulated provisions.

b) Consumer protection and conduct Issues-

- All loan disbursals and repayments are required to be executed only between the bank accounts and borrower and the Regulated Entity (RE).

- No creation of any passthrough/pool account of the Lender Service Provider(LSP) or any third party.

- Any other fees or charges payable to LSPs in the credit intermediation process shall be paid directly by RE and not by the person who has borrowed.

c) A Standardized key fact statement(KFS) must be given to the borrower before executing the loan contract-

- Automatic increment of credit limit without explicit consent of borrower is prohibited.

- There should be a cooling-off/look-up period during which the borrowers can exit digital loans.

- It can be done by paying the principal and the proportionate APR.

- And without any penalty shall be provided as the loan contract.

- It should maintain a suitable nodal grievance redressal officer to deal with FinTech/digital lending-related complaints.

d) Technology and data requirements-

- Data collected should not be mandatory, it should be as per the need.

- Auditing of the data should have clear trails and it should be done only with the prior consent of the borrower.

- Options may be provided to the borrowers to accept or deny the consent for use of specific data.

- Including the option to cancel previously granted consent.

- There will be an option to delete the data collected from borrowers by the LSP.

e) Regulatory Framework-

- Any lending sourced through DLAs is necessary to be reported to Credit Information Companies(CICs).

- All new digital lending products extended over business platforms.

- Also involves short-term credit.

- Temporary postponement or deferred payments are required to be reported to CICs by the REs.

Advantages-

- Increases affordability.

- Instant access to credit.

- Safe and secure transaction.

- Can choose repayment tenure i.e. flexible in nature.

- No cost EMI.

- Simple process.

Disadvantages

- They may encourage impulse spending.

- Late payment fees.

- Can impact your ability to apply for loans.

- Minimal credit checks.

Read more on TechRuled